bid to buy ask to sell

Answer 1 of 3. The 100000 units EUR traded.

What Is Spread And It S Impact What Is A Spread By Mankenavenkatesh Medium

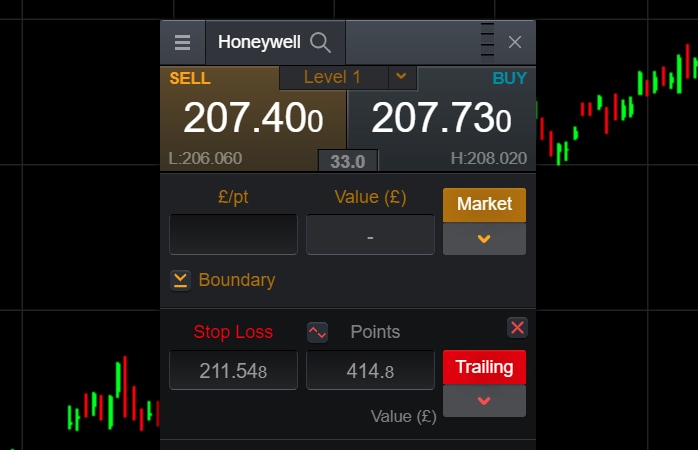

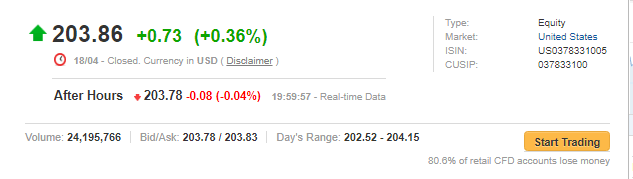

The ask the lowest price at which any market participant has.

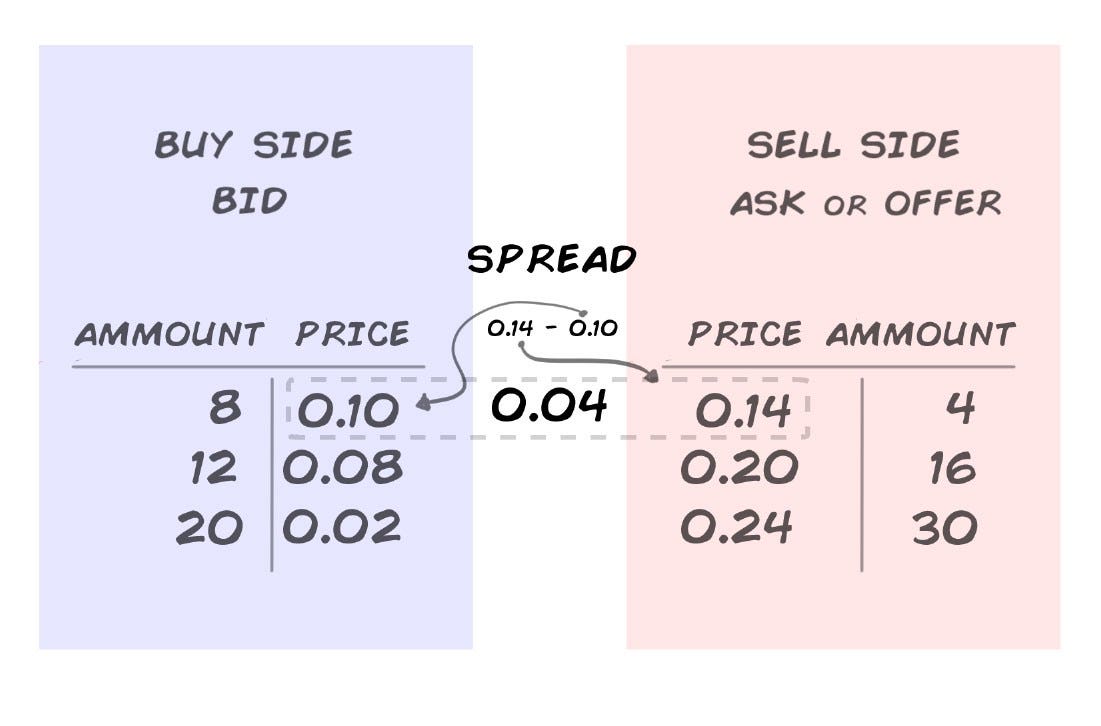

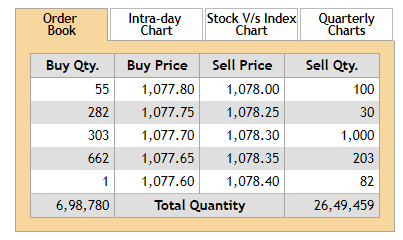

. So a market maker puts in a bid when he wants to buy but the trade only. Except there are millions of traders buying and selling thousands of different stocks every day. The bid vs ask represents the prices that buyers are willing to pay bid and what prices the sellers are willing to sell at ask.

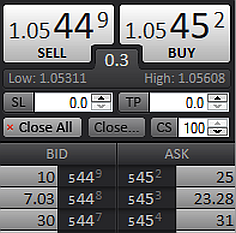

Buy Bid will enter a buy order to match the bid which requires the sellers to. Bid price represent the price buyer is willing to pay for the stock. In normal circumstances the bid.

Only a desparate seller can sell at Bid price. Bid and Asked. A decent understanding of the bid and.

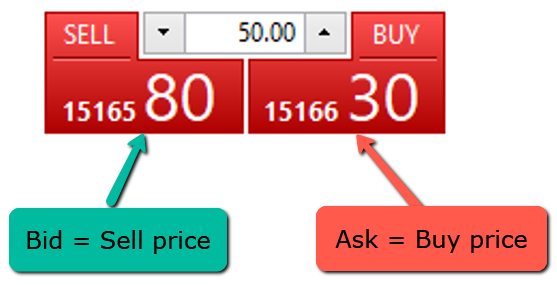

The word bid is the price someone is willing to buy The word ask is the price someone is willing to sell also sometimes referred to as an offer. We sell Treasury Bills Bills for terms ranging from four weeks to 52 weeks. When you put a request to buy a stock at a certain price you are placing a bid.

This is exactly how bid and ask work on the stock market. Option Bid Ask Spread Explained. As a trader it is vital to understand what the bid and ask are and how placing orders can affect your trade executions.

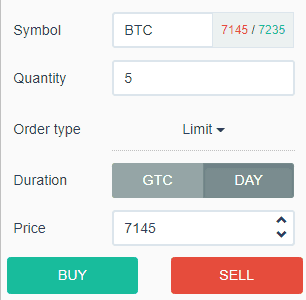

At its core bid is the. This is true for all limit orders. If you buy the ask this is a limit order at the best ask price.

You can not buy at Bid price. Buy ask is an aggressive order that matches the ASK where you expect a quick execution. If you are looking to buy into a stock using a market order you will fill at the ask price.

With normal stocks its usually 3 days. Understanding The Bid-Ask Spread. The bid the highest price at which any market participant has expressed a willingness to buy the product.

To answer this question we need to understand what bid and ask prices actually are. Bid to buy ask to sell. To understand why there.

28 2022 529 pm ET. The price is guaranteed but there is a risk of not getting filled. Bills are sold at a discount or at par face value.

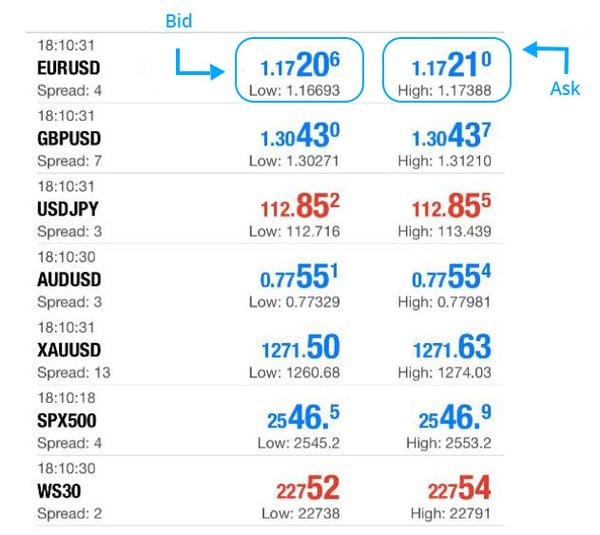

So you just place limit order and wait for. The only persons who REALLY buy at bid and sell at ask are market makers. As per the bid and ask price in the above image sellers will pay 092388 to sell while buyers will pay 092406 to buy the trading asset.

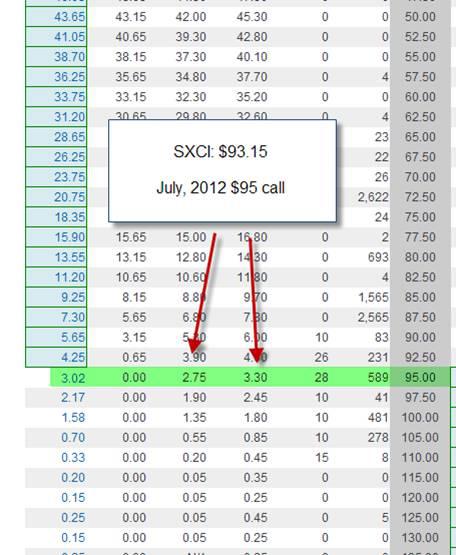

This is usually represented in. When you make a trade the money needs to settle. For any financial instrument be it a stock or an option there is a bid price and an ask price.

Bid and Ask is a two-way price quotation that indicates the best price at which a security can be sold and bought at a given point in time. During this waiting period its considered in limbo transit and. When the bill matures you are paid its face value.

The bid price is the best highest price someone is. Spread is essentially a small cost built into the bid and ask prices offered by a broker to buy or sell a currency. 2 minutes LONDONThe Bank of England launched an emergency intervention to restore order in bond markets after a.

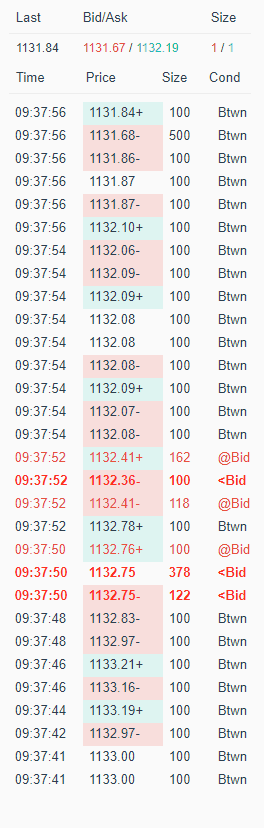

The bid size and ask size represent the number of stock or other securities that traders are willing to buy or sell at a certain bid price or ask price. Your order of 1132 would now replace the current bid offer of 113167. With options its usually one day.

Sellers will now see 1132 and depending on their eagerness to sell may lower their price to meet. Instead of queuing on the opposite price some professional options traders do what we call.

The Bid Ask Spread And How It Affects Trading Prices And Orders Trade That Swing

Understanding Bid And Ask Prices

Bid And Ask Price Example Of Bid Ask Spread Cmc Markets

Negotiating The Bid Ask Spread Using The Show Or File Rule Seeking Alpha

Bid Vs Ask Vs Spread Small Big Things That Destroy Your Performance Living From Trading

Order Flow Fundamentals In Futures Trading Explained Step By Step

Bid Ask Interpreting Buying Selling Pressure In Trading Tradingsim

Bid Ask Rates Beginner S Guide For 2022 Asktraders Com

What Is A Stock Spread Answered

Bid And Ask Prices Definition Investing Com

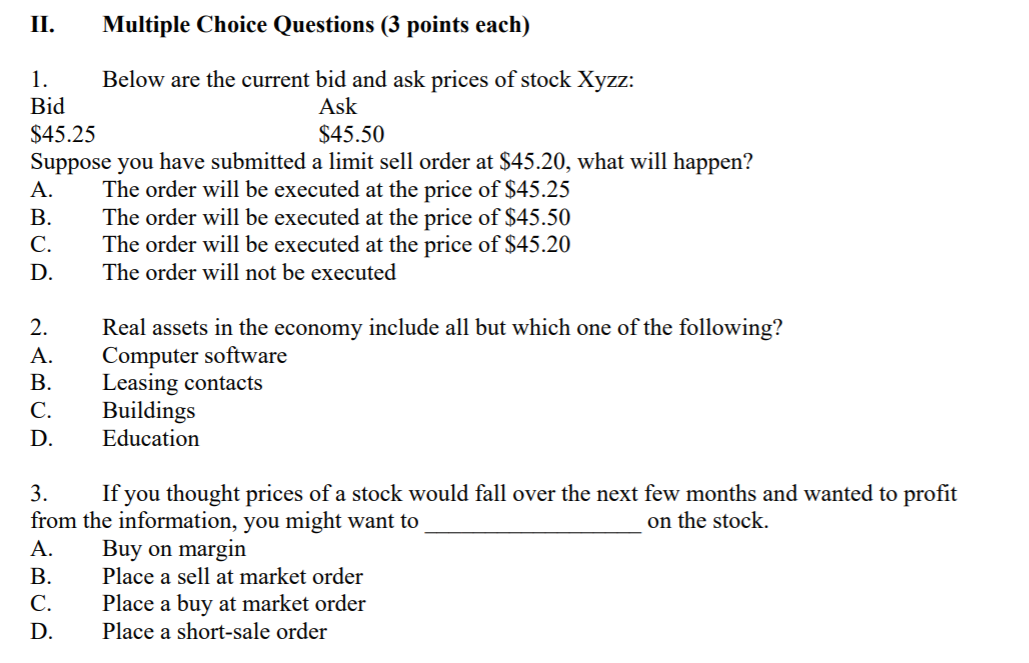

Solved Ii Multiple Choice Questions 3 Points Each 1 Chegg Com

Why The Bid And Ask Price Matter When Trading Stocks Etfs Mybanktracker

Bid Vs Ask Price Top 6 Best Differences Infographics

Bid Ask Spread What It Is How It Works Seeking Alpha

The Private Banker Bid Ask Trading Glossary

Bid Ask Spread How It Works In Trading Bankrate

Options Money Maker Trader S Guide To Options Part 1 The Information In This Guide Is Intended To Get You Started With Your Understanding Of Options The Terminology And Their Basic Characteristics